The financial services industry is undergoing a radical transformation, driven by rapid advancements in information technology (IT). From mobile banking to blockchain, the integration of IT is reshaping how financial institutions operate and how customers interact with financial services. This blog post delves into the multifaceted impact of IT on financial services, highlighting key trends, technologies, and their implications for the future.

Digital Banking and Mobile Solutions

One of the most significant impacts of IT on financial services is the rise of digital banking. Gone are the days when customers had to visit a physical branch for their banking needs. Today, with the proliferation of smartphones and internet connectivity, digital banking solutions have become ubiquitous.

Mobile Banking Apps

Financial institutions have developed sophisticated mobile apps that allow customers to perform a wide range of transactions, from checking account balances to transferring money, paying bills, and even applying for loans. These apps often come with features like biometric authentication, ensuring secure and convenient access.

Online Banking Platforms

Beyond mobile apps, comprehensive online banking platforms offer a seamless experience for desktop users. These platforms provide tools for financial planning, investment management, and personalized financial advice.

Blockchain and Cryptocurrencies

Blockchain technology is revolutionizing the financial services sector by introducing a new level of transparency, security, and efficiency. Cryptocurrencies, which are built on blockchain technology, have also emerged as a disruptive force.

Blockchain

This decentralized ledger technology ensures that transactions are secure, transparent, and immutable. Financial institutions are leveraging blockchain for various applications, including cross-border payments, trade finance, and compliance with regulatory requirements.

Cryptocurrencies

Bitcoin, Ethereum, and other cryptocurrencies have gained significant traction as alternative assets. Financial institutions are increasingly exploring the integration of cryptocurrencies into their offerings, providing services like crypto trading and custody.

Artificial Intelligence and Machine Learning

Artificial intelligence (AI) and machine learning (ML) are transforming financial services by enhancing decision-making, improving customer experiences, and automating complex processes.

Risk Management

AI and ML algorithms are used to analyze vast amounts of data, enabling financial institutions to better assess and manage risks. Predictive analytics help in identifying potential fraud, credit risk, and market trends.

Customer Service

AI-powered chatbots and virtual assistants are enhancing customer service by providing instant, accurate responses to customer queries. These tools are available 24/7, improving customer satisfaction and reducing operational costs.

Personalized Financial Services

Machine learning models analyze customer behavior and financial data to offer personalized financial products and services. This includes tailored investment advice, customized loan offers, and targeted financial planning.

Fintech and Innovation

The rise of fintech startups has introduced a wave of innovation in financial services. These agile companies leverage cutting-edge technology to offer niche financial products and services, challenging traditional financial institutions.

Peer-to-Peer Lending

Platforms like LendingClub and Prosper enable individuals to lend money directly to others, bypassing traditional banks. This model offers competitive interest rates and quicker access to funds.

Robo-Advisors

Automated investment platforms, such as Betterment and Wealthfront, use algorithms to manage investment portfolios. These robo-advisors provide cost-effective, efficient, and personalized investment management.

Insurtech

The insurance industry is also experiencing disruption with the advent of insurtech startups. These companies use technology to streamline insurance processes, from underwriting to claims management, improving efficiency and customer experience.

Cybersecurity and Regulatory Compliance

As financial services become increasingly digitized, the importance of cybersecurity and regulatory compliance cannot be overstated. Financial institutions must protect sensitive customer data and comply with stringent regulations.

Cybersecurity Measures

Advanced cybersecurity technologies, including encryption, multi-factor authentication, and anomaly detection systems, are employed to safeguard financial data. Regular security audits and penetration testing help identify and mitigate vulnerabilities.

Regulatory Compliance

Financial institutions must navigate a complex regulatory landscape. IT solutions, such as regulatory technology (regtech), assist in automating compliance processes, ensuring adherence to regulations like GDPR, AML, and KYC.

Bottom Line

The integration of IT into financial services is not just a trend but a fundamental shift that is reshaping the industry. From enhancing customer experiences to improving operational efficiency and enabling innovative financial products, IT is at the heart of this transformation. As technology continues to evolve, financial institutions must stay agile and embrace these changes to stay competitive and meet the ever-changing demands of their customers.

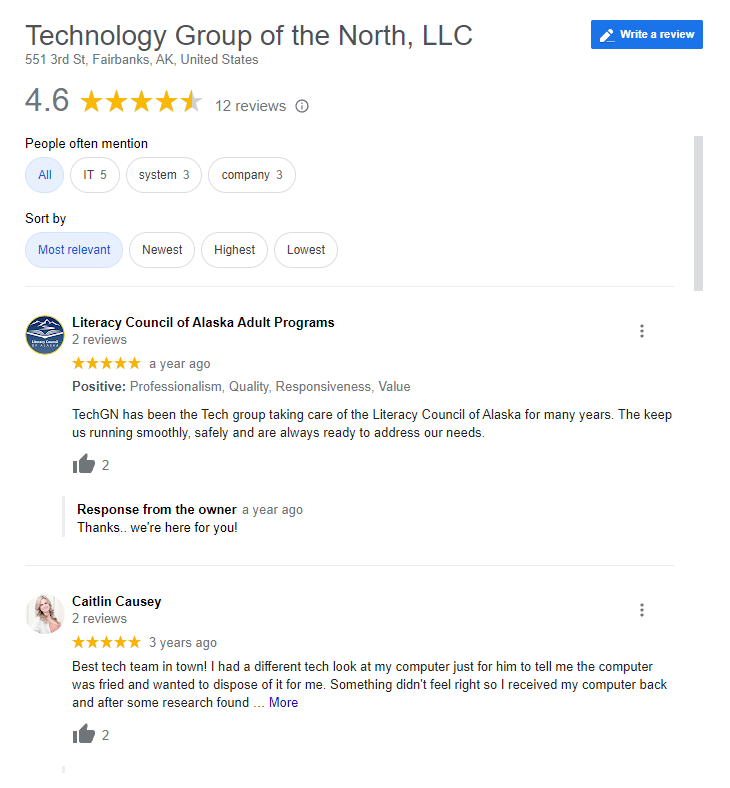

Reviews

Tailoring Solutions